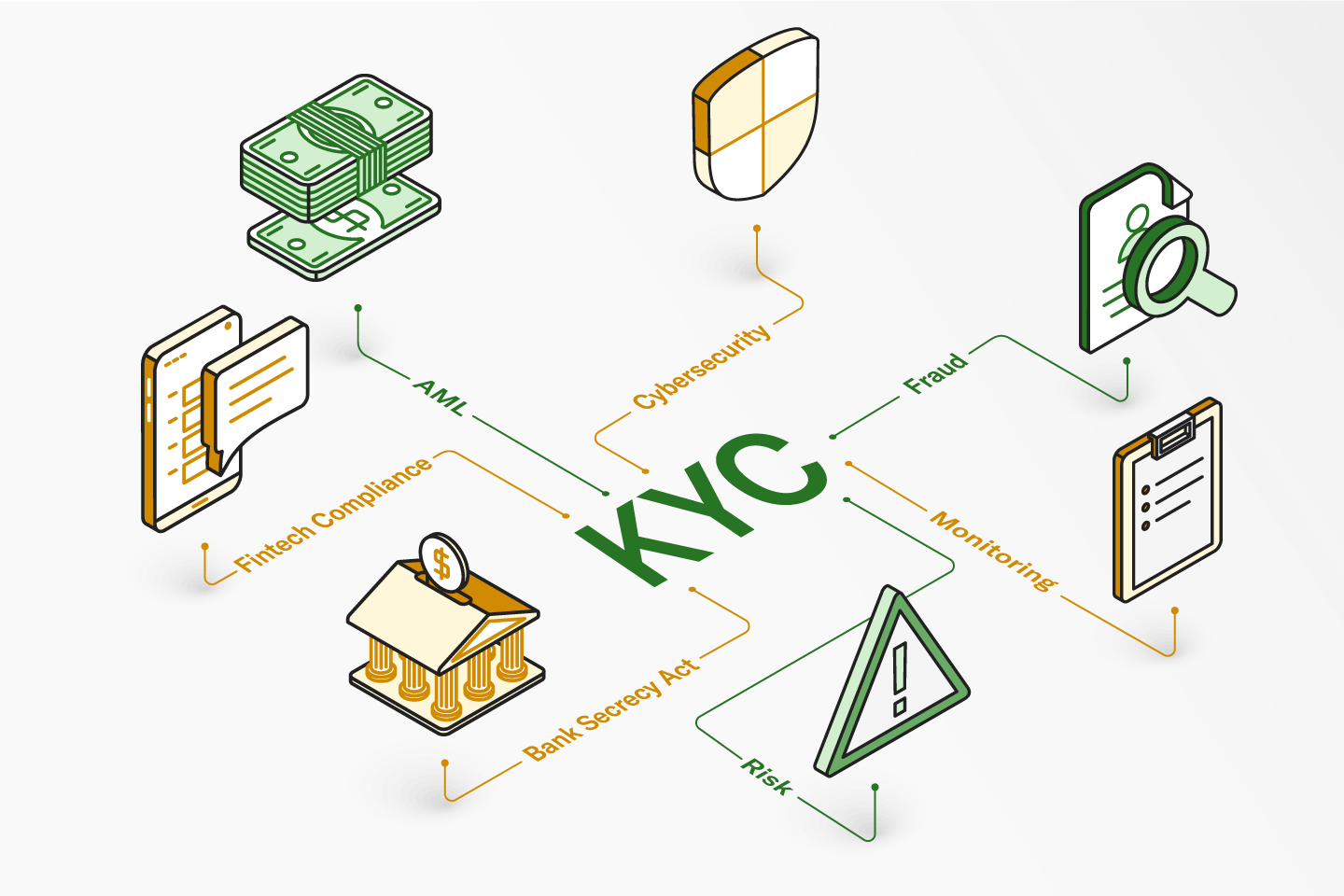

Know Your Client (KYC) arrangements have become progressively necessary in the advanced business scene, particularly in areas like money, however whether or not they are obligatory for all businesses is nuanced and relies upon different variables. The top 10 KYC platforms offer comprehensive solutions for efficient and secure identity verification in various industries.

In numerous enterprises, especially monetary administrations, KYC arrangements are suggested as well as are required by regulation. State run administrations and administrative bodies across the globe have executed severe KYC guidelines to battle illegal tax avoidance, psychological militant funding, and other monetary wrongdoings. Monetary organizations are committed with comply to these guidelines to keep up with the respectability of the monetary framework. Resistance can bring about serious lawful outcomes, including powerful fines and endorses, which can essentially influence a business’ tasks and notoriety.

The prerequisite for KYC arrangements stretches out past customary banking and monetary administrations. Numerous different areas, including fintech, land, and, surprisingly, certain parts of the retail business, are dependent upon KYC guidelines. The extension and particulars of these necessities might change by ward and industry, yet the hidden guideline continues as before – businesses should check the character of their clients to forestall unlawful exercises and guarantee consistence with the law.

In any case, the compulsory idea of KYC answers for businesses likewise relies upon elements, for example, the size and nature of the business, the locales in which it works, and the sort of exchanges it conducts. Private companies may not be dependent upon similar administrative investigation as enormous worldwide enterprises, yet they are not altogether absolved. Neighborhood regulations and industry-explicit guidelines might in any case require some degree of client check.

Indeed, even businesses working in locales with less severe guidelines can profit from executing KYC arrangements willfully. Proactively taking on KYC estimates upgrades the security of exchanges as well as fabricates entrust with clients. In a period where information breaks and data fraud are on the ascent, clients value businesses that focus on the security of their own data.

In Conclusion, while KYC arrangements are compulsory for specific businesses, particularly in the monetary area, their need shifts across enterprises and purviews. Nonetheless, the worldwide pattern towards expanded guideline and the developing accentuation on forestalling monetary violations propose that KYC arrangements are turning out to be to a greater extent a standard practice rather than a discretionary one. Explore the top 10 KYC platforms for robust identity verification and compliance in diverse industries globally.