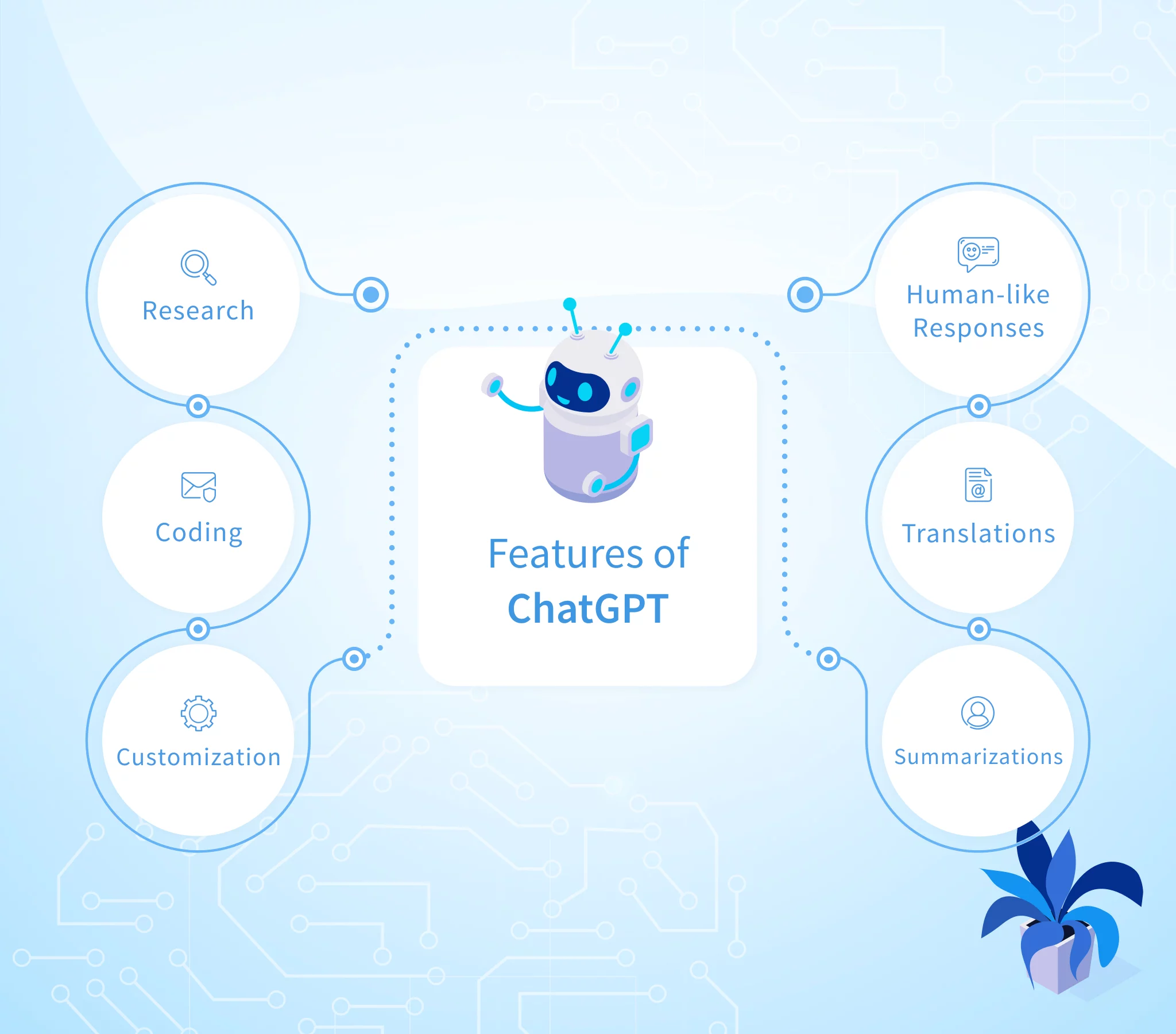

Several Uses Of The Ultimate AI Chatbot Assistant ChatGPT

What makes work fast and reliable in today’s generation is mostly done with AIs. These are Artificial intelligence-powered tools that make the work done easy and fast, such as:

- Creating contents

- Writing music

- Coding assistance

- Manipulating media files

- Job interview preparation

- Chat Companion

- Writing essays

- Cooking assistance, and a lot more

AI Customer Support Chatbot helps increase daily work efficiency and it knows everything about the four aspects of creating data about the following:

- Your business

- Your competitors

- Your work

- Your studies

Why do students prefer the chatbot tool?

What else can you expect from a chatbot that can give you 100% content creation of human-like written content? There is no other than the AI Customer Support Chatbot. It can answer a lot of questions and can provide you with cohesive questions on several topics. Most students preferred to use this chatbot tool on their thesis and survey projects because it can create practical applications, such as:

- creating customized resumes

- crafting jokes

- explaining complex topics

- solving math problems

- providing relationship advice

Chatbot for job seekers

ChatGPT can quickly write customized cover letters and resumes. If you are currently hunting for a job, one of the requirements for the job application process is writing a personalized cover letter and resume. Personalized cover letters and resumes are asked for every job when you apply for a job. But, you can’t simply write one copy for each job. It is the time when you can have custom-made copies to increase your chances of getting hired.

ChatGPT helps you craft professional cover letters or create a customized resume in a few minutes

Solve tricky math problems

What makes the AI-powered tool ChatGPT more realistic and useful is being a math problem solver. Most people would say that mathematics is the most difficult subject ever encountered during their primary school days up to college days. Whenever they meet numbers, they would say boring or complex subjects, which is very true. However, did you know that ChatGPT can solve math problems and explain tricky math problems step-by-step?

Indeed, more students recently are using ChatGPT to help them understand and solve math problems, not to copy the created math problem explanation. Instead, to come up with a formula to understand the math problem.

Many students and businesses today face less work because of the help of AI-powered tools. It doesn’t only help them solve problems but helps their work be more productive each day.

Continue Reading